Polymarket Has a Truth Problem

The recent scandal is just the latest from a system designed to benefit insiders

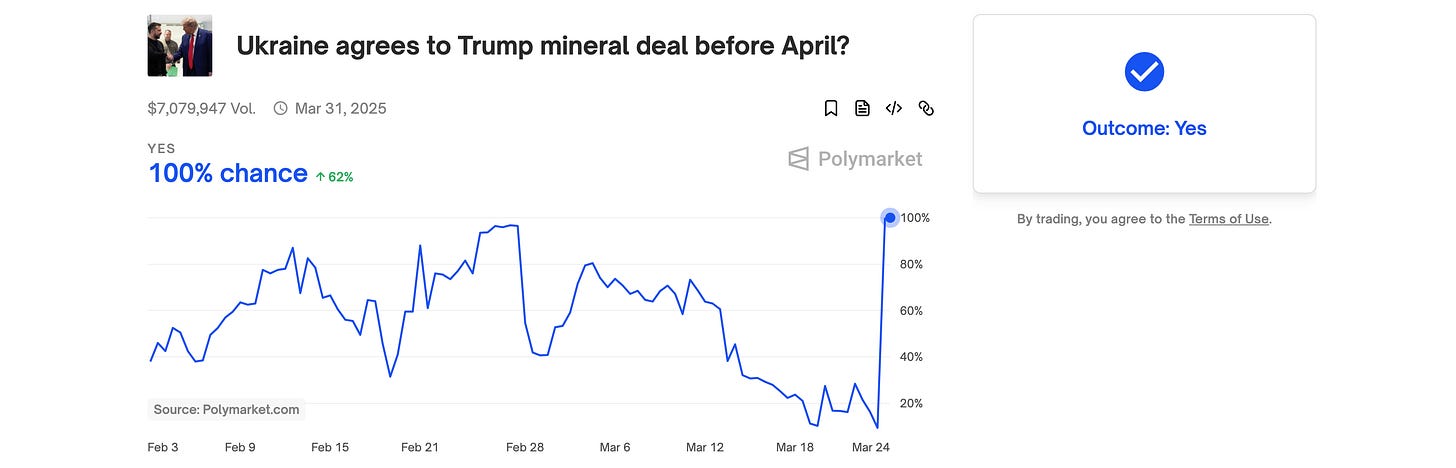

There's been a recent cluster of news coverage about a $7M market that resolved incorrectly on Polymarket, with all funds lost and no recourse offered to users.[1] Polymarket publicly acknowledged that this resolved incorrectly, referring to it a governance attack, but that framing obfuscates the truth — events like this routinely occur and consistently benefit the same people.

Prediction markets have become a fixture in the financial and political ecosystem — promising to forecast future events, directly gauge public sentiment, and inform public policy, all while allowing users to profit from their predictions. Polymarket is the world’s largest online prediction market platform and is reportedly valued at close to $1B. Volume and user growth have surged, with over 300,000 users and trading volume reportedly exceeding $9B in 2024.[2,3,4,5]

Though it may appear otherwise from the outside, Polymarket doesn’t actually decide on the outcomes of its markets. Instead, they rely on UMA (Universal Market Access), an open-source project that describes itself as "a decentralized truth machine."[6] UMA resolves disputes through a manual voting process, with each staked UMA token conferring a single vote. However, a majority of these tokens are owned by just a few individuals, some of whom are known to participate in the markets and profit from their outcomes.

In order to reach consensus, tokenholders are encouraged to discuss markets publicly before voting. The insiders and so-called whales who control large portions of voting shares weigh in by signaling how they intend to vote. UMA’s voting system discourages disagreement and punishes users who vote against the majority by reducing their tokens. Predictably, many voters choose to mimic these whales rather than rely on their own judgment. The result is a system that perpetually rewards the elite and punishes dissent — all at the expense of Polymarket’s broader user base.

Recent efforts have been made to obscure this concentration of power by mass-creating and funding hundreds of new voting wallets, but it is well-documented that the same users dominate the discourse and resolutions repeatedly. A single user — borntoolate.eth — is known to control approximately 25% of all voting power.

These systemic flaws have led to repeated abuse. Standards of proof shift arbitrarily. Conflicts of interest go undisclosed. Markets are routinely resolved in ways that override community consensus and ignore available evidence. In order to prevent false, inaccurate, or biased resolutions, Polymarket can insert clarifications to market rules, but when UMA votes against those clarifications, Polymarket neither intervenes nor offers recourse.

The recently covered Ukraine minerals deal resolution illustrates how this dynamic plays out in practice. A market asked whether a minerals deal would be agreed upon with Ukraine.[7] A well-known insider proposed the market resolve as "Yes" before any such deal had been agreed upon. During the voting process, Polymarket issued a clarification stating the answer was not "Yes." Despite this, a small group of whales voted in favor and in the final minutes, the market resolved as "Yes" — resulting in immense losses for retail users. Many users lost in excess of $10,000 and several took losses of over $100,000.

The Polymarket Discord has become a reflection of the platform’s deeper issues. Confused and frustrated users join with predictable regularity to voice their concerns and seek answers. The Polymarket staff, though responsive on other issues, do not directly engage with these concerns, and there’s an inevitable feeling of hopelessness among those seeking recompense. Amid this frustration, calls to replace UMA have grown louder. UMA’s token is down more than 70% over the past four months, reflecting declining confidence in their integrity and future viability. From the outside, the system appears impartial and rule-based. Inside, it functions more like a cartel — unaccountable, coordinated, and self-serving.

As Polymarket continues to grow in scale and influence, these systemic issues demand deeper scrutiny. We've compiled data on key elements of this story — including who controls which voting shares, which markets were decided incorrectly or against Polymarket’s instructions, how much money was impacted, and who benefited. If this story matters to you, please share it and join us in Discord.

Sources:

[1] https://www.coindesk.com/markets/2025/03/27/polymarket-uma-communities-lock-horns-after-usd7m-ukraine-bet-resolves

[2] https://nymag.com/intelligencer/article/is-polymarket-legal-politics-betting-shayne-coplan.html

[3] https://cryptorank.io/ico/polymarket

[4] https://coinmarketcap.com/academy/article/4caf631f-e3c5-4300-8646-e33228bad9df

[5] https://www.theblock.co/post/333050/polymarkets-huge-year-9-billion-in-volume-and-314000-active-traders-redefine-prediction-markets

[6] https://umaproject.org/?

[7] https://polymarket.com/event/ukraine-agrees-to-give-trump-rare-earth-metals-before-april/ukraine-agrees-to-give-trump-rare-earth-metals-before-april?tid=1743254115453

Additional markets:

Check this active Bitcoin Strategic Reserve market being scammed in real time right now here: https://substack.com/inbox/post/160215350